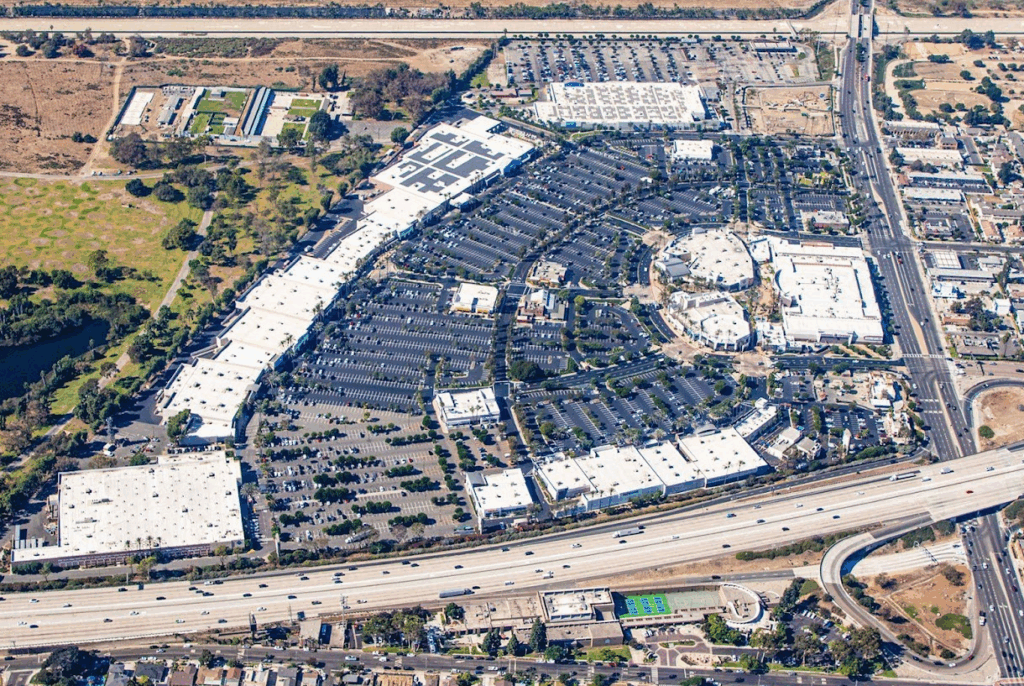

The Long Beach Towne Center, a 100-acre complex on Carson Street in East Long Beach, has been sold for $143 million to CenterCal Properties of Costa Mesa and New York-based DRA Advisors.

The center, the largest outdoor mall in Long Beach, has 870,000 square feet of leasable space and is anchored by 75 retail and service stores, restaurants, 4,500 parking spaces and a 26-screen Regal Edwards theater.

Its sale on Aug. 19 marks the first transfer of ownership for the property since its 1998 construction, a replacement for the former naval hospital decommissioned in 1994.

Its construction was a $70 million venture by its previous manager, the Phoenix-based Vestar Property Management, that was announced in 1992 — one year after the federal government ordered the naval hospital closed.

In many ways, the center embodies the city’s transition from a Navy-based economy to a bulwark of entertainment, retail and tourism. According to its sale listing, it’s the busiest strip in a 15-mile radius, attracting more than 12 million customers annually and hosts thousands of workers at businesses that stay for an average of six years.

Given its age, the new managers said investments into the property will accompany the sale.

Without placing a specific dollar figure, CenterCal Properties CEO Jean Paul Wardy said Thursday the sale will come with some site improvements, from a renovated plaza to signage, lighting and parking. There is also interest, Wardy added, to bring in some new businesses.

“We’re kind of evaluating all those options now,” Wardy said. “We think the community is really going to be excited.”

Walmart, Lowe’s, Sam’s Club, Regal and Dave & Buster’s are among the keystone tenants at the center.

CenterCal Properties also owns 2nd and PCH, a newer outdoor mall that opened in 2019. It has more than 215,000 square feet of retail and restaurant space in an array of two-story buildings – anchored by a 45,000-square-foot Whole Foods Market. The real estate company also owns properties in Idaho, Oregon, Utah and Washington.

DRA Advisors, a New York investment group, has approximately $42 billion of real estate, including more than 100 million square feet of industrial, 86,800 multifamily units, 90 million square feet of retail, and 66 million square feet of office.