A draft form of the California Statewide Housing Assessment report has begun circulating through public workshops and its findings are not good news for those looking to one day own a home. The report found that household growth will outpace household construction by about 100,000 homes annually and the gap could continue to lead to an increase of the number of people who are burdened by housing costs.

California’s Housing Future: Challenges and Opportunities, the first report of its kind since 2000, revealed that over the past 15 years Californians have been among the most troubled by real estate issues in the country, with its home ownership sinking to levels not seen since the 1940s and over a third of state households being cost-burdened—paying over 30 percent of their income toward housing.

According to the report, the state needs 1.8 million new homes by 2025 to keep pace with projected population growth, and it presented the challenges facing the state in that quest as well as potential solutions.

There are over 39 million people living in California in 13 million households and many, like those in Long Beach, have seen both the price of rent and average cost of purchasing a home rise over the past few years.

There are over 39 million people living in California in 13 million households and many, like those in Long Beach, have seen both the price of rent and average cost of purchasing a home rise over the past few years.

While these issues may seem to be endemic to those living in large population centers, the report points out that it affects those living in rural parts of the state as those people often travel farther distances to work, which often negates the savings they experience from lower housing prices.

“As affordability becomes more problematic, people “overpay” for housing, “over-commute” by driving long distances between home and work, and “overcrowd” by sharing space to the point that quality of life is severely impacted,” the report said.

Overcrowding is defined as having more than one person per room, including living rooms, kitchens, etc. The state’s overcrowding rate is 8.4 percent, more than double the national average and that number gets worse when looking at just those who rent. Renters experience overcrowding at a rate of 13.5 percent according to the report, more than triple the rate of those that own homes.

When accounting for the increased travel, the report used a metric that has yet to be adopted but could soon be the bar for measuring combined housing and travel burden for residents. Set at 50 percent of monthly income, those living in Los Angeles County pay about 57 percent of their monthly income to travel and housing while those living in neighboring Orange County pay 55 percent on average.

Cost burdens have historically been believed to affect only those in the lowest income brackets, but as the report pointed out, it’s starting to creep up to affect higher wage earners as supply continues to shrink and demand increases or remains static.

In the 10 largest metropolitan areas in the state, some 75 percent of renters making between $30,000 and $45,000 were considered cost-burdened. Half of those making $45,000 and $75,000 are now considered cost-burdened.

Screenshot of the report’s graphic highlighting cost-burden by county.

The report showed that to remain under the cost-burden threshold a person working full-time at $10 an hour, the state minimum wage at the time it was compiled, a person could afford $520 per month in housing costs. At $15 per hour, the targeted minimum wage for the state by 2022, a person can afford about $780 per month in housing costs.

Sharing living spaces has become a necessity in most towns and cities in the state, especially those in coastal communities as rents in particular have continued to grow despite the Great Recession. The newest census figures show that when accounting for cost of living, California actually has the highest poverty rate in the nation at 20.6 percent.

Spurred by new renters entering the market, former homeowners losing their homes and becoming renters and reduced access to home mortgages as banks tightened policies after the housing collapse, demand for rental units has grown and the price to live in them has trended upward, the report said.

In analyzing median rents in all 58 counties across the state, no county had a median monthly rent under $1,100 per month. A study put out last year by the University of Southern California Lusk Center for Real Estate projected the median rent for Los Angeles County to top $1,400 by 2018. Rents in Long Beach paced behind the county average by about $40 per month.

What could add to this problem is that nearly 36,000 affordable units in the state are at risk of becoming converted to market rate during the next one to five years as their contracts come to their end.

Long Beach has built about 1,800 affordable units in the city over the last decade while preserving another 2,093 units.

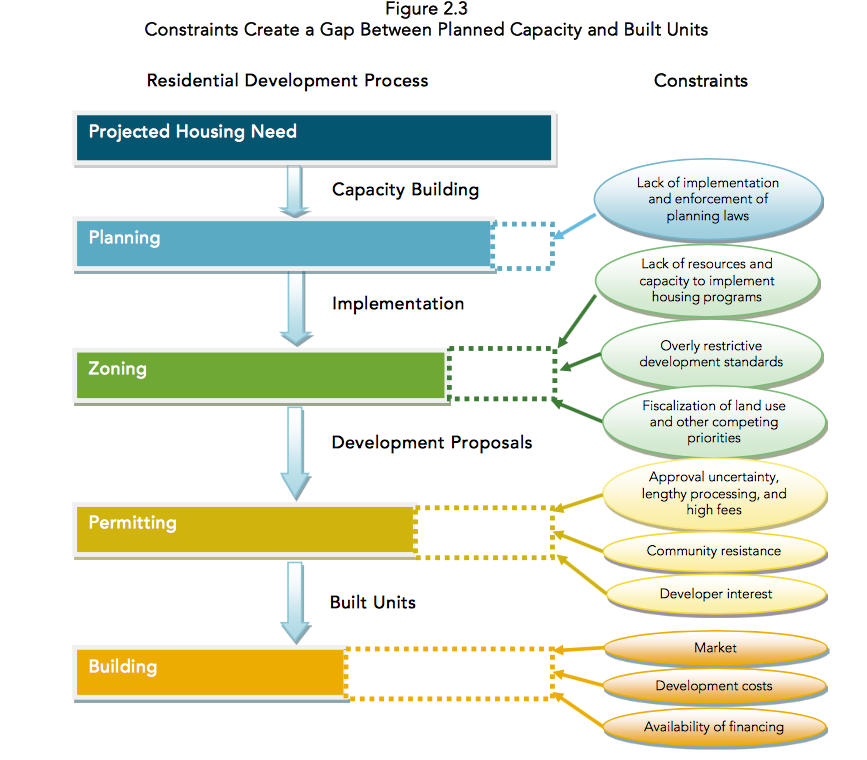

Screenshot of the report’s breakdown of roadblocks for developers.

Recently, multiple high density projects centered in the downtown sector were either approved or broke ground and those will add needed density and units in a city that has a vacancy rate in the low single digits.

Mayor Robert Garcia led a series of meetings late last year to address the issue of housing. He noted that many of the new projects—and their high-end rents—will serve the “changing workforce” in the city, but also recognized that for the city’s economy to be strong it has to work for everyone. Later this month, the city council will host a study session on affordable housing.

The report’s authors offered up several possible remedies including reforming land use policies to make it more affordable and attractive to developers who wish to build new housing units, investing more in rental and home ownership assistance and community development as well as taking a tougher look at housing access for vulnerable populations like homeless and elderly populations.

Still in draft form, the report as well as its suggested policies are subject to public comment at scheduled workshops throughout the state. The closest one to Long Beach will be held Friday in Los Angeles. A finished version of the report is tentatively scheduled to be released during the summer.

Southern California Association of Governments is located at 818 West Seventh Street 12th Floor Los Angeles, CA 90017. Click here to RSVP. The Long Beach City Council will discuss housing during a study session scheduled for February 21 at 5PM.