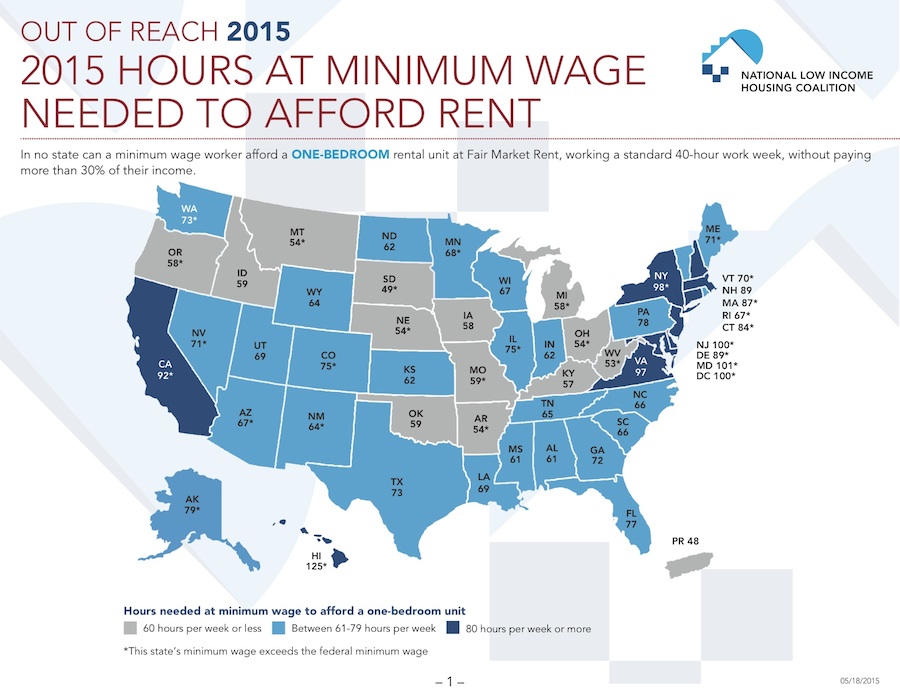

A map showing the amount of hours worked needed to afford a 2-bedroom rental unit while making minimum wage. Photo: National Low Income Housing Coalition

If you make minimum wage and rent in the Los Angeles-Long Beach metro area, you’d better get some coffee ready, as it will require you to have multiple full-time jobs in order to pay up to your landlord each month. This estimation was part of Out of Reach, the annual report from the National Low Income Housing Coalition (NLIHC) that highlights the gaps between wages and the cost of living in cities across the country.

The group that advocates for affordable housing has compiled the Out of Reach report since 1989. This year’s edition ranked California as the third most expensive state to live in, with six of the state’s counties ranking as the top 10 most expensive places in which to rent. The $26.65 per hour housing wage—the estimated figure it would take for a person, working a 40-hour work week, to afford a modest two-bedroom home while not spending more than 30 percent of their income on rent—falls only behind Hawaii and the District of Columbia as the highest statewide housing wage figure.

In the LA-Long Beach area, the figure is slightly higher at $27.38 per hour with the fair market rent for a two-bedroom unit being $1,424. Fair market rent is a figure determined by the United States Department of Housing and Urban Development and is based on the 40th percentile of gross rents for typical, non-substandard rental units.

To put that into terms of what it would take to afford that 2-bedroom unit on a minimum wage paycheck, a person would have to work 122 hours per week. If you’re in the market for a studio or single bedroom, it would require 78 and 94 hours per week, respectively.

The coalition’s report was released the same day that the Los Angeles City Council voted nearly unanimously to raise the city’s minimum wage to $15 per hour by the end of the decade. However, according the report, that figure would still be about $12 short per hour to afford a 2-bedroom unit and $2.50 per hour less than would be needed to afford a one-bedroom unit.

“The main point is that wages are not keeping up with housing costs,” said Megan Bolton, a research director with the coalition. “It’s really difficult for low wage workers to afford rental units right now pretty much all across the country, in both rural and urban areas.”

She applauded cities like Los Angeles, Seattle and San Francisco that have already passed legislation to raise the wages of its lowest wage workers, and others like New York, Kansas City and D.C. that have proposals on the books.

“We definitely see a lot of states and cities taking action when the federal government hasn’t,” Bolton said, describing the federal minimum wage of $7.25 established in 2009 as stagnant. “People are understanding of that just isn’t a living wage and are taking action.”

Whether Long Beach will follow suit and raise minimum wage in the city is something that’s yet to be brought to the table, but if the city did, many people would stand to benefit from it. According to the 2007-2011 American Community Survey, 45 percent of households in the city earned less than $50,000 per year and nearly 60 percent of residents rent in the city.

Affordability is defined by a federal standard that states no more than 30 percent of a household’s gross income should be spent on rent or utilities. Those paying over the 30 percent threshold are considered cost-burdened, and those paying over half their gross income are deemed severely cost-burdened. Taking into account the report’s findings that an annual income of over $56,000 to afford a home in the LA-Long Beach area, it becomes clear that about half the city cannot afford to live here.

Affordability is defined by a federal standard that states no more than 30 percent of a household’s gross income should be spent on rent or utilities. Those paying over the 30 percent threshold are considered cost-burdened, and those paying over half their gross income are deemed severely cost-burdened. Taking into account the report’s findings that an annual income of over $56,000 to afford a home in the LA-Long Beach area, it becomes clear that about half the city cannot afford to live here.

Mayor Robert Garcia was unavailable for comment today, despite the Post‘s numerous inquiries regarding yesterday’s vote in LA and how it might affect Long Beach lawmakers going forward. Raising the minimum wage in the city wouldn’t happen overnight, as demonstrated by the LA vote, which withstood months of debate and protests before ultimately being passed. However, with Democrats at the national level focused on raising the federal minimum wage and Garcia’s close relationship with LA’s Mayor Eric Garcetti, the idea that Long Beach could soon be discussing wage increases isn’t far-fetched.

In November 2012, Long Beach hotel workers received a wage increase to over $13 per hour, but that was the result of a ballot measure, not a city council vote. Randy Gordon, president and chief executive of the Long Beach Area Chamber of Commerce, told the LA Times that the 2012 vote was “one of the worst measures in the history of Long Beach.”

The vote passed with over 60 percent approval from residents. The decision preceded one hotel owner in the city laying off his entire staff of over 70 people a week before the newly passed minimum wage went into effect. Those types of layoffs were what opponents of the LA measure warned businesses could resort to in attempts to absorb the greater overhead operations.

Raising wages is only part of the equation to making cities nationwide more affordable Bolton said. She estimates that there’s a shortfall of 7.1 million affordable housing units in the country. Bolton said stagnant wages need to be dissolved and coincide with the introduction of new affordable housing, not new luxury apartment complexes that further the problem of pricing people out of markets.

“Even with raising the minimum wage, it’s hard to find units to afford without spending the majority of it on housing cost,” Bolton said.