Renters are continuing to feel the squeeze of rising housing costs, but as overall rent appreciation slows, there may be some relief on the horizon.

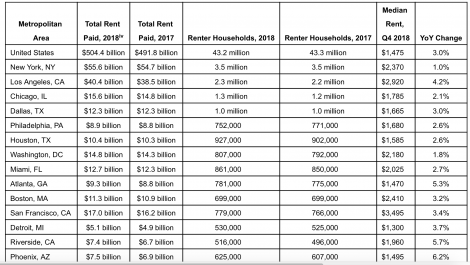

A new study by apartment listing site HotPads found that renters across the nation spent a record $504.4 billion on housing in 2018, up $12.6 billion from last year. But while renters are paying more than ever, appreciation has slowed compared to previous years, giving more people the chance to save for a down payment on a home.

Nationwide, median rent rose 3 percent to $1,475 this year, following a gradual slowdown in rent prices that began in mid-2016.

“If interest rates continue rising in 2019, more would-be homebuyers may decide to continue renting, which could put additional pressure on rent prices,” Joshua Clark, an economist at HotPads said in a statement. “Fortunately for renters, the housing market is also cooling nationwide, signaling that the entire market may be leveling off and making it easier for renters to keep up with housing expenses.”

The Los Angeles metro area still saw one of the highest increases at 4.2 percent, for a median rent of $2,920. Overall, renters in the Los Angeles area spent $40 billion this year.

The growth was hotter in other areas.

Las Vegas saw an increase of 6.5 percent, while rents in Phoenix and Riverside jumped 6.2 percent and 5.7 percent, respectively.

New Yorkers spent the most this year for a total of $55.6 billion, but rents increased by just 1 percent, compared to 1.8 percent last year.

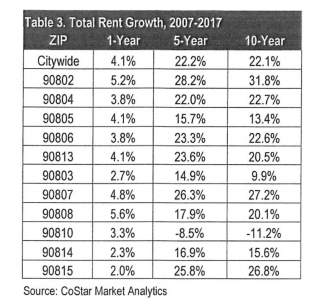

While Long Beach, like most of Southern California, has seen record increases, rates are slowing slightly and remain blow the peak of about 6 percent in 2015, according to study from CoStar Market Analytics.

In 2017, Long Beach’s mean rent grew from $1,280 to $1,333 for a 4.1 percent increase. Downtown’s 90802 ZIP code saw the hottest growth for an increase of 5.2 percent last year and an overall increase of 32 percent from 2007 through 2017.

This year, median rent increased by about 3 percent and is expected to stay roughly the same next year before dropping slightly, according to the report.

Pat Cassara, a realtor with Keller Williams Realty, said the city’s influx of new housing will help offset rising rents.

“Until they build more rental units we’re going to continue to see the increase,” he said.

The city is in the midst of a $3.5 billion construction boom that will include 5,000 new residential units, of which about 800 would be affordable housing.

But as many residents, especially in the Downtown area, are displaced due to rising housing costs, the issue of rent control will likely remain on the battleground in 2019.

California’s Proposition 10, an effort that would have given local governments the authority to expand rent control, failed on the November ballot, but renters rights’ activists say they’ll continue to fight.

Last week, a temporary rent control ordinance went into effect for unincorporated areas of Los Angeles County. The ordinance, in effect for the next six months, limits rent increases to 3 percent a year and places restrictions on tenant evictions.