The Long Beach Rebellion campaign against Measure A has described it as a blank check for Mayor Robert Garcia. Photo by Jason Ruiz.

With the June 7 primary inching nearer, the residents of Long Beach are facing a dwindling window in which to consider votes that could have lasting impacts on the community and the nation.

For whom will you vote to assume the Second District city council seat? Which presidential candidate is best suited to lead the country? Do you support a one percent sales tax increase to address the city’s crumbling infrastructure and public safety needs?

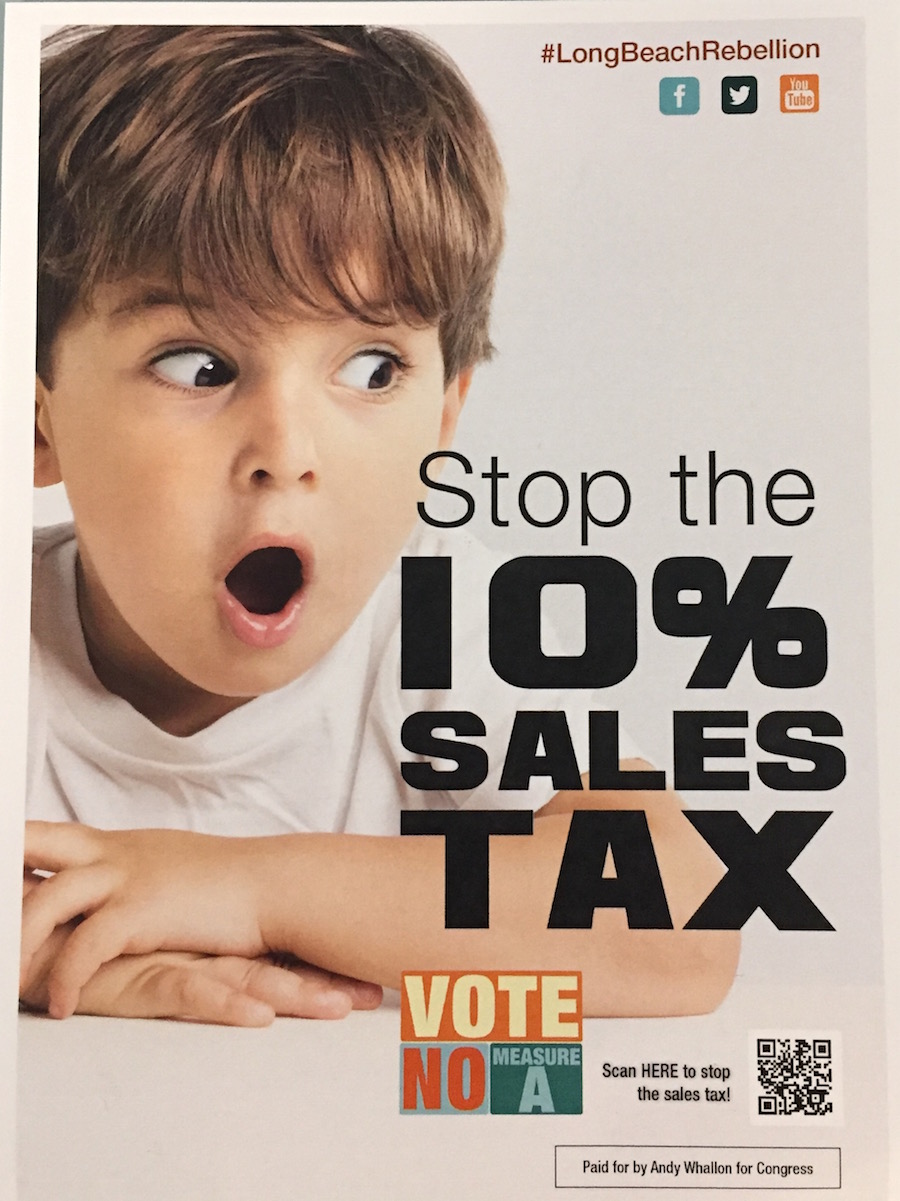

The last question has rankled a number of residents who argue that any raise in the sales tax will render the city uncompetitive with surrounding municipalities with lower sales tax figures, and that it will unfairly affect the poor and elderly who live on fixed incomes. The issue has even hit the federal level, as a group supporting 47th Congressional District Candidate Andy Whallon has taken up the anti-Measure A mantle which it characterizes as a “blank check” for Long Beach Mayor Robert Garcia.

“If people believe that the funds are going to be used to get more police and more fire then they’re going to get behind it,” said Long Beach Rebellion press secretary Franklin Sims. “But the thing is, there’s so much other debt in Long Beach what happens when the city council finds some other priority that they think is really pressing and there’s nothing to stop them from using it?”

Whallon is running against Congressman Alan Lowenthal to represent the district in Congress, a battle he lost two years ago to Lowenthal. Sims said the Rebellion group campaigning on his behalf against a local sales tax issue is odd, but it makes sense since Whallon is a conservative and would fight tax increases at the federal level if elected.

“All politics are local,” Sims said. “So once you get people sort of desensitized to what happens to their wallet at the local level it’s easy at the national level to tax people even more.”

The group has launched a website denouncing Measure A, has distributed anti-Measure A leaflets to businesses—some in the form of a literal blank check made out to the mayor—and launched a recent campaign that is calling on all members of the council to commit one year’s salary to charity if the measure passes and the funds don’t go to their proposed purposes.

The group has launched a website denouncing Measure A, has distributed anti-Measure A leaflets to businesses—some in the form of a literal blank check made out to the mayor—and launched a recent campaign that is calling on all members of the council to commit one year’s salary to charity if the measure passes and the funds don’t go to their proposed purposes.

Adding fuel to the fire of the dissenters is the fact that the Long Beach Fire and Police Departments, two entities that serve to benefit from the passage of Measure A, have been the biggest monetary supporters of it.

According to campaign finance documents, political action committees representing the fire and police departments not only helped fund the initial study that showed the city’s voters would support Measure A if it went to the ballot in June, but they have subsequently poured over $150,000 combined to help fund the marketing of the measure.

In an argument supporting the tax increase, Garcia and former Mayors Bob Foster and Beverly O’Neill said the safeguards in place—a citizen advisory committee appointed by the mayor and confirmed by the council that oversees expenditures, annual audits by the city auditor and a resolution passed by council that prioritizes infrastructure and public safety when spending the funds—are enough to ease the concerns of those opposed to the measure.

Measure A would increase the Long Beach sales tax from nine to ten percent for six years and then “sunset” to 9.5 percent for the remaining four years of the ten-year increase. The less controversial Measure B would create a new rainy day fund that would stash one percent of all new revenue to the general fund to address the city’s future infrastructure needs.

The projected $48 million in annual revenue that could come from Measure A passing is advertised as a tool to address the city’s crumbling infrastructure, which by the city’s official projections stands to have an operation deficit of about $2.8 billion over the next decade.

The city estimates that over $65 million is already spent annually on infrastructure, a figure that doesn’t come close to covering the deficit.

Garcia has also expressed that the money will be used to address staffing levels for both fire and police in the city to help combat the rise in crime and to maintain or improve 911 response times. Over the last 10 years, the city has slashed some 700 city positions, including 200 police officers, to offset the recession of the mid-2000s.

In an interview, Garcia pointed out that while other municipalities around Long Beach, including its own school districts have passed general revenue measures in recent history, the city has gone over 35 years without passing one. He said the Measure A dollar figure represents about half that of the Long Beach City College Bond Measure, which will also be on ballots this year. His message to voters: it’s time.

“When it comes to Long Beach, the information that we’re telling folks is people have a tradition of investing in the public good, back into the community but it’s time to invest in Long Beach,” Garcia said. “That’s the key message. It’s time to invest in our cops, in our firefighters and fixing our city’s infrastructure because we haven’t done it in 35 years.”

Part of the mistrust articulated by the public stems from the wording of the measure, which states pretty clearly how the tax will be implemented, what exemptions apply and how it will sunset to half a cent after six years, but makes no mention of what the projected revenue will be spent on.

This has led some to question whether funds raised by the measure would go toward the stated goals of the council and the mayor, or if they would simply go toward giving raises to city employees that have taken a backseat while the city has slashed its budget.

Garcia said that the current expenditures may fluctuate, since not all of that money comes from the city’s funds, but instead is a conglomeration of state, county and local revenue sources. But he asserted that even if those funding levels decrease, the city’s commitment would remain the same.

Garcia said that the current expenditures may fluctuate, since not all of that money comes from the city’s funds, but instead is a conglomeration of state, county and local revenue sources. But he asserted that even if those funding levels decrease, the city’s commitment would remain the same.

“I don’t know that we’ll spend $65 million next year—it’s completely dependent on what we get from the state and the county,” Garcia said. “The city’s contribution will absolutely continue. The only way we’re going to make a long-term dent in the $2.8 billion deferred maintenance deficit that we have is if we invest as much as possible in infrastructure.”

But what does Measure A really break down to when you pair it down to dollars and cents for the taxpayers of Long Beach?

According to the latest census information the median income is just under $53,000 annually in Long Beach and the California Legislative Analyst’s Office estimates that consumers spend about a third of that income on taxable goods—a number that has declined since peaking in the 1980s. Using those numbers, the sales tax would amount to an average increase of $175 annually, or $14.58 per month.

However, Garcia said that because Measure A does not apply to essentials like groceries or medicine, that figure actually drops down further to about $5.67 per month per person.

“What we know is it’s basically the cost of Starbucks coffee,” Garcia said. “The key essentials, particularly for low-income folks which end up being food and medicine are not included in this.”

Sims and others still argue that the dollar figure, no matter what it is, will place an unfair burden on the poor and those with fixed incomes. He said while he doesn’t believe that most people would follow through on their threats to drive outside the city’s bounds to avoid the one percent tax increase, the ones most affected by infrastructure and public safety needs don’t even have the choice.

“The same people who are feeling the response times are the same people who don’t really have the option to drive out,” Sims said. “They’re kind of landlocked and to me that’s one of the most unfair things about the sales tax.”

The mayor sought to address the fairness aspect in his campaign for Measure A, noting that unlike raising a property tax, a sales tax increase applies to everyone who works, lives or merely visits Long Beach.

“The millions of people that come in to Long Beach annually, that work here, that visit here, that are on the cruise lines, that fly into the airport, that don’t live in the city will all be contributing to this to make our city better,” Garcia said.