Long Beach voters will not be asked to approve a property tax hike in November to pay for city services, after a city-commissioned poll found they are likely to oppose it.

The poll, obtained by the Post through a public records request, introduced the idea of a parcel tax that levies 8 cents per square foot of land, equivalent to $630 more a year for the average Long Beach homeowner. The new tax would have required the approval of two-thirds of Long Beach voters.

Officials hoped it would bring in $200 million per year, though they later realized it would need to be triple the figure they polled on, closer to $1,800 for the average homeowner, to collect that amount.

Responses from 871 residents — through telephone calls, or online surveys from Oct. 14 to 22 — found that 80% said it is not the right time to raise taxes, even if the money is needed to cover services — street repairs, police and fire — that might otherwise be lost.

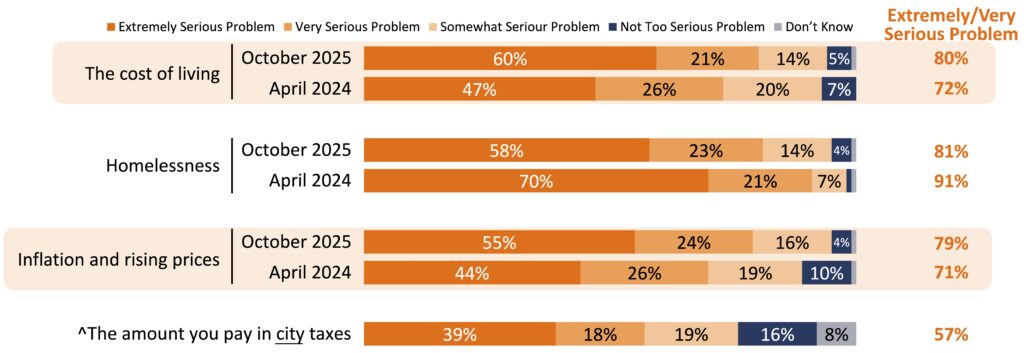

It’s a reversal of public confidence from 18 months ago, when a majority of Long Beach voters agreed to local and county taxes meant to pay for public safety, curb homelessness and stem a growing mental health crisis. Now, respondents said their own economic well-being — including cost of living, inflation and rising prices — is a more pressing issue than crime and on-par with homelessness.

FM3 Research, which ran the poll, said voters appeared to be in a “highly pessimistic mood.” Many “hold a negative view of their city, most think the economy is getting worse, and almost half feel their own personal finances have deteriorated in the past year.”

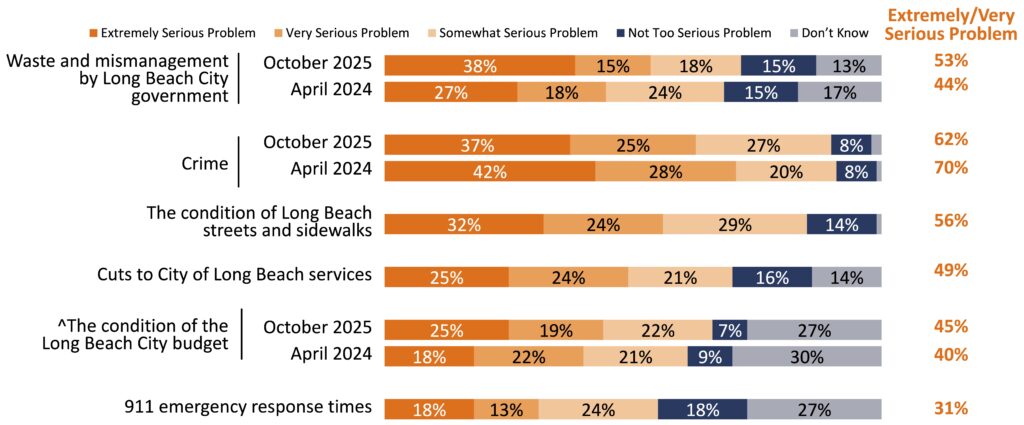

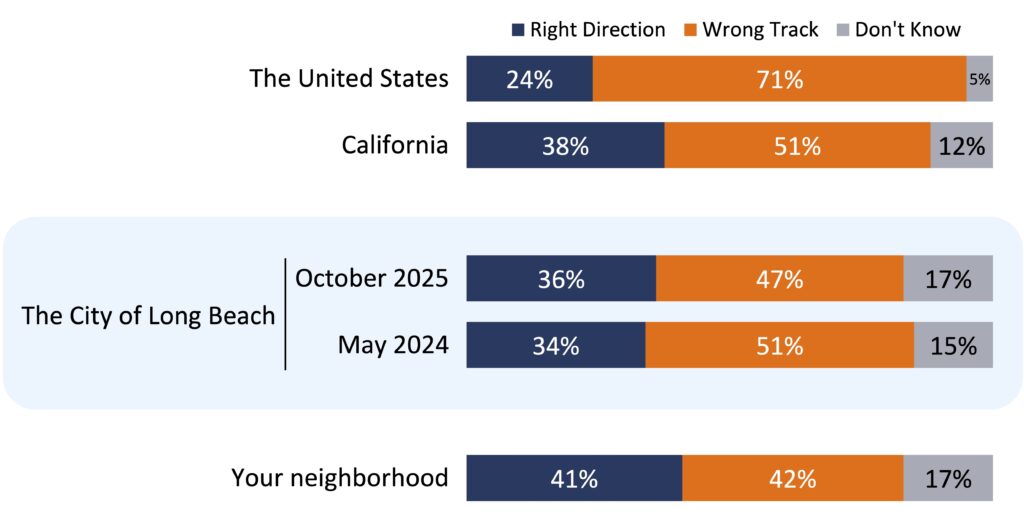

Of those surveyed, 47% said Long Beach was headed in the wrong direction; 48% said their own financial situations had worsened, and 53% said waste and mismanagement by city government was an extremely or very serious problem.

Their broader outlook was even worse, with 51% saying the state was on the wrong track and 71% saying the same about the nation. A majority of Black voters, however, held a favorable view of the city’s direction, while whites, Latinos and Asians or Pacific Islanders saw it in a negative light.

The poll’s margin of error was 3.5 percentage points.

Ahead of his 2026 State of the City address on Tuesday, Mayor Rex Richardson blamed national rhetoric for driving down trust in all levels of government, regardless of who runs it.

“When you have folks at the very top of government who question public health and question data,” Richardson said. “What do you really have to count on if we can’t trust facts and data and common sense anymore?”

He said it’s “unfortunate that the spirit of the times affects our ability to keep people safe.”

Even on a nonpartisan local measure, the poll showed sharp political divisions, with 77% of Republicans opposed to the property tax increase compared to 32% of Democrats. Fifty-three percent of independents were also opposed.

This comes as Richardson and city management are under mounting pressure to right Long Beach’s finances. The city faces a $60 million structural shortfall through 2023, meaning it’s expected to face a deficit each consecutive year, including $40 million this year. Historically crucial oil revenues are in steady decline, and federal cuts have axed some city health programs.

After exhausting its remaining carryover funds from COVID-19 relief programs, the city has about $13 million in operating reserves, a couple of million in the city’s “rainy day fund” and about $60 million in emergency reserves.

Without new monies, City Manager Tom Modica said cuts are likely in the coming fiscal year. Unable to comment on specifics, he said the city will have a better idea by April.

Voters appeared to be aware of the budget problems. Most agreed the city needs more revenue to avoid layoffs or an end to programs, with many supporting subsidizing the construction of affordable housing, building homeless shelters, stabilizing the city health department, and maintaining public parks and libraries.

In the long run, however, most saw higher taxes as a greater evil than further reductions in city services, with more than half saying they already pay too much.

Homeowners, a crucial voting bloc that represents an outsized share of the local electorate despite being a minority of the population, opposed the tax at 58%. Sixty-four percent of renters supported it. The city’s last attempt to raise property taxes in 2008 also failed with 52.8% of the vote.

The results indicate the magnitude of the challenge that leaders face in framing solutions to such complex problems that can win broad public and political support while not hurting constituents’ pocketbooks.

Richardson believes he’s built an agenda that threads that needle, citing an 84% increase in homeless shelters, speedier hiring of public employees and an expanded police academy with a record number of recruits.

“You have to show that you can deliver results,” Richardson said. “Every time we break ground on a project, every time we deliver a new street… it rebuilds a little bit of hope that government works and can work.”

He was scheduled to outline the next steps in his vision, which included a heavy focus on economic development, in his 2026 State of the City Tuesday night.

Editor’s note: This story originally said the city was refunded for the cost of the poll because of an error by a third-party tax consultant hired to perform research in preparation for the polling. The city later clarified that is incorrect. It was only reimbursed for the cost of the third-party tax consultant’s work. It still paid for the cost of the polling.